Mortgage Market Review

Mortgage & Property Market Update following the recent positive inflation data

Consumer Price Inflation (CPI) falls to 7.90%

The inflation data that’s released monthly is the key determinate for the Bank of England’s Monetary Policy Committee (MPC) when setting their base rate. On Wednesday, the UK CPI data for June came in at 7.90%. This is a reduction of 0.80% from the previous month and, importantly, is lower than the 8.20% predicted by economists. The previous two months’ inflation data was a surprise to many, forcing the MPC to increase their base rate by 0.50% last month and indicating to the markets that more rate increases were needed in the coming months. This meant that all UK mortgage lenders rapidly increased their fixed rates.Getting inflation down in the coming months will ease the pressure on the MPC when they’re considering further base rate increases. Personally, I think they should pause the rate rises now, just like the Federal Reserve did in the US last month. However, after two years of very poor forecasting, they’ll likely feel pressured to increase again at the August meeting - but only by 0.25% this time.

Inflation will continue to fall in the coming months

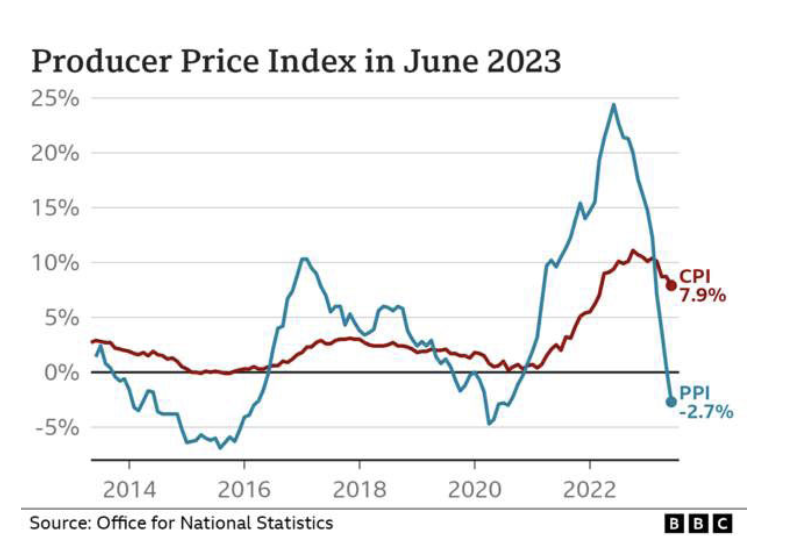

Going forward, it now looks clear to me that inflation will keep falling in the coming months. The energy price cap reduced significantly on 1st July, but this won’t show up until the next inflation data is released on 16th August. Beyond that, it’s worth looking at the Producer Price Index (PPI) which is rarely talked about in the media, but historically has proven to be a leading indicator for CPI. The PPI measures the price of goods being sold by manufacturers which of course is determined by production costs. The graph highlights that PPI slumped during the 2020 lock down when there was no demand for goods, then increased rapidly to almost 25% when we came out of lockdown and demand for goods went crazy.

This month, PPI has gone negative mainly due to significant reductions in the price of fuel, which incidentally are now back to the cost prior to the Ukraine conflict. No one expects CPI or core inflation to go negative anytime soon, but the graph highlights a clear trend of CPI following PPI, hence it’ll continue to reduce in the coming months.

What does this mean for fixed mortgage rates?

In the last two months lenders have increased their prime borrower fixed rates significantly from a range of 4%-4.5% to 5.25%-5.75%, which is similar to where they were following the mini budget last year. These increases were a reaction to the poor inflation data and heightened recession indicators which results in lenders tightening credit policy and lifting rates, as no one wants to have the ‘best buy’ product. Thankfully, in the last two weeks, the positive news on inflation firstly in the US and on Wednesday in the UK has led to big reductions in the sterling SWAPS markets where lenders hedge their fixes rates.

The table below highlights reductions over 0.65% on the key 2- and 5-year SWAPS, which should mean that lenders start to reduce rates soon, however, I think just like last autumn it may take a couple of months to do so. The reason I feel they’ll hold off is because they are ahead of target this year due to the amount of refinance business they committed to in April and May, as most borrowers looked to secure a product when it became obvious that rates were about to increase. This was certainly the case with our brokerage and having correctly advised clients not to fix last autumn when rates were very high, in the three months from March to May we’ve secured treble the amount of refinance business that we would ordinarily transact - in most cases at rates 1%-1.5% below where they were last autumn and now.

Top Tip - We strongly advise all borrowers securing fixed rates now that they should only do so if the lender allows you to change to a lower rate should they launch one prior to completion, as it’s highly likely fixed rates will reduce in the coming months.

| 6th July | Today | Reduction | |

|---|---|---|---|

| 2-Year | 6.08% | 5.43% | 0.65% |

| 5-Year | 5.35% | 4.66% | 0.69% |

Trackers products are proving sweet again

Lenders are currently offering tracker products at skinny margins from just 0.15% above the base rate for a current rate payable of 5.15%. Clearly, there is a risk involved with these products as it is expected base rate will increase in the coming months. However, these products generally have no early repayment charges and come with the option of switching to a lenders fixed rate at any time.

If I were personally buying right now (I’m not) I’d prefer a tracker at 5.15% than a fixed rate at 5.75% for 2 years, or 5.35% for 5 years, as I believe base rate won’t increase much further and may start reducing a year from now, maybe quicker if we enter a recession. I just don’t like the idea of fixing long term at current high rates, particularly as such products carry hefty early repayment charges.

It is of course all about the client’s preferences and risk profile. Our job as brokers is simply to listen, provide the options, list the pros and cons of each product so that a client has a well-informed choice to enable them to select the right product for them.

Back in my day comparison

The perennial inter-generational debate about mortgage rates and property prices usually includes “back in my day, interest rates were 12%”, and “yes, but prices are 6 x higher now”. The fairest way to compare this is to look at the proportion of take-home pay being spent on mortgage payments by first time buyers. It is of course all about the client’s preferences and risk profile. Our job as brokers is simply to listen, provide the options, list the pros and cons of each product so that a client has a well-informed choice to enable them to select the right product for them.

The graph which runs from 1985 highlights that the recent interest rate rises have lifted the proportion to just under 40% which is seen as a danger threshold from a credit perspective, though it’s still a fair bit lower than what it was in the early 90s when base rates reached 12% and

in 2008 at the start of the financial crisis, both of which precipitated a large correction in house prices.

Are prices going to crash?

This spring, the deals we saw being negotiated in what was quite a buoyant market appeared to be about 5% below the market peak last summer (area / property dependant). However, in real terms, after factoring in inflation of 10% this is actually at 15% reduction already. If the base rate were to increase to 6% and stayed there for a prolonged period, then I’m sure the 5% reduction in cash terms would become 15%-20%. However, it now looks unlikely that the base rate will get to 6%, and if we compare the UK now to the previous house price crashes in the early 1990s and late 2000s there are far more support measures this time, including:

• Strong labour market and low unemployment.

• Continued neti mmigration which house building doesn’t keep up with.

• More single occupancy households increasing demand for housing.

• Strong underwriting standards over the past decade resulting in less impairments.

• Increased lender forbearance measures resulting in a low level of repossessions.

• Well capitalised UK banking sector with most banks having strong balance sheets.

Our overriding view and best guess is that in around three years from now, prices will be similar to what they were last year so little change in cash terms. If we factor in the likely inflation over the period 2022-2026 this does constitute a reduction of between 20-25% in real terms, based on current inflation expectations. Essentially, what we're saying, is the general rate of inflation will correct the price naturally rather than there being a major reduction in the price paid.

Is a buying opportunity upon us?

Right now, while mortgage rates are high there are less buyers about and those that are willing to commit to a purchase hold most of the cards in terms of negotiating with sellers. This does create an arbitrage opportunity for a buyer in that they’re able to negotiate a reduced price now in a weak market, but if the transaction takes three or four months to complete, it’s highly likely that by the time of completion they will qualify for a lower rate.

I’ll wait six months and see where rates are

We hear a lot of this and it’s natural to do this when mortgage rates are where they are, but if everyone takes this approach once rates do fall there’ll be a stampede of buyers returning to the market at the same time, so they’ll be less able to negotiate a lower price. As ever, please contact us if you or your friends, family or colleagues require any mortgage advice.

How Can Jordan Lynch Help?

If you’re purchasing a new property, the process can take several months and if we arrange your mortgage, we’ll constantly review your product right up to completion to ensure that you obtain the lowest rate possible by the time you collect the keys. If you’re a homeowner and your mortgage product expires this year, we will book the best available re- mortgage or retention product for you six months in advance but will ensure that this is a product that can be cancelled, so if more favourable products are launched in the interim period (likely to be the case) we will switch you to one of those prior to completion.

Call us on 0161 486 9316 or email enquiries@jordanlynch.com to learn more.